Selling your house in Massachusetts (or any state for that matter) has certain costs associated with it, both for the home buyer and the home seller. These standard fees are called closing costs, and they’re all laid out on a document you get before closing called a HUD-1 Settlement Statement.

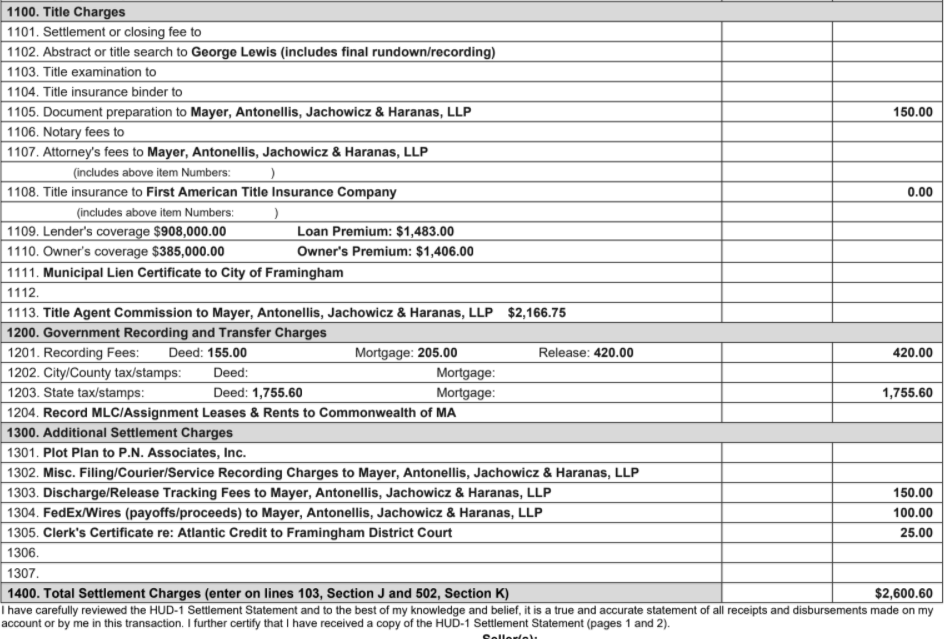

The HUD, which we’ll break down here, typically looks something like this:

Unfortunately, closing costs an unavoidable part of any real estate transaction in the state of Massachusetts.

For a home seller, a good rule of thumb is to assume about 0.9% of the sales price will go toward these costs, at least here in Massachusetts. So for a home selling for $500,000, expect to pay (or negotiate for the buyer to pay, if you can) about $4500 in costs.

The good news is these fees should NEVER come directly out of your pocket. They are taken out of the sales proceeds at closing, so you don’t have to worry about coming up with that money.

But what are these fees exactly? Why do they exist, and how much does each one cost? Today, we’re going to tell you everything you need to know about Massachusetts closing costs for sellers.

Attorney Fees: $800-1200

Attorneys are an important part of Massachusetts real estate transactions because they handle most of the paperwork involved, ranging from the purchase and sale agreement to the deed itself. They make sure the home sale goes through efficiently and legally.

Rather than charging hourly, most closing attorneys charge a flat fee for their services, which roughly corresponds to the amount of work that will be required (some transactions are more labor-intensive than others).

As a general rule, these services cost anywhere from $500 to the low-$1000 range.

If you’d like a referral to a vetted local attorney that keeps her fees low, we’re happy to provide one.

Sales Tax: Varies

Sadly, whenever Uncle Sam sees that you’re making money, he always wants his cut.

In Massachusetts, the seller pays a tax (called a “stamp tax” or “transfer tax”) when transferring his property to a new owner. This is NOT the same as a regular income tax (or a capital gains tax); a transfer tax specifically taxes the transfer of the deed and gets paid at closing.

In most of Massachusetts, the tax is $4.56 for every $1000 of the sales price. So if your property sells for $500,000, the government takes $4.56 x 500, or $2280, at closing.

For some unfortunate reason, the tax is $6.48 for every $1000 in Barnstable County (Cape Cod). So be aware of this if you’re selling your house on the Cape.

Recording Fees: $200-500

When a property sells, certain documents have to be recorded in the public record, at a government office called the Registry of Deeds. These documents include the new deed, as well as any releases for mortgages or liens (debts) the seller had on the property.

The government, always looking for revenue, charges money to have these documents recorded. Typically, it costs around $150 to record the deed and another several hundred to record the discharges on old mortgages, if there are any.

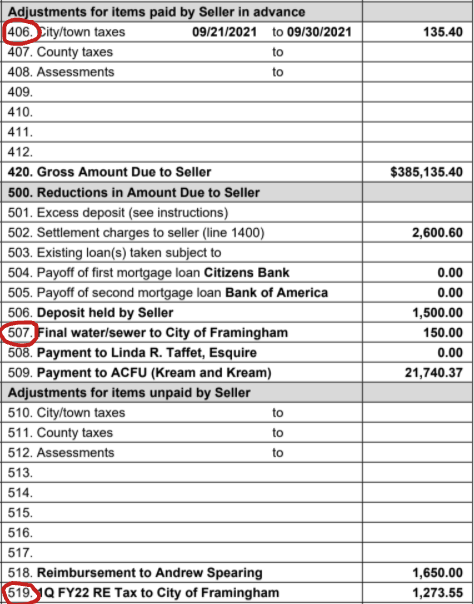

Pro-Rated and Unpaid Bills: Varies

Because property taxes are paid on a quarterly basis, the buyer and seller split those costs when the property sells.

For example, if the seller owns the house for half the quarter and then sells it to the buyer, each party is responsible for 50% of the property tax bill at the end of the quarter.

So in this example, if the seller already paid all his quarterly taxes in advance, the buyer would have to reimburse the seller for 50% of the tax bill.

However, if the seller didn’t yet pay anything, the seller would have to put up 50% at closing. That’s exactly what’s happening in line 519 of this example HUD.

In addition to unpaid property taxes, there may also be unpaid water/sewer bills and local taxes. The seller will have to take care of those at closing as well, which is shown in lines 406 and 507.

These Costs Are Totally Negotiable With The Buyer

While closing costs are unavoidable, in the sense that someone has to pay them, you may be able to get the buyer to pay them for you. As cash home buyers in Massachusetts, we have offered to cover the seller’s closing costs on multiple occasions to sweeten the deal for them. We may be able to do the same in your case, just depending on how the offer is structured. If this is something that interests you, let us know and we’ll see what we might be able to do for you!

Also, you can check out this handy calculator to get a sense of what the costs could look like for your home.

And if you have any questions about closing costs, HUDs ,or any other topic, feel free to reach out at (617) 831 6186 and we’ll be happy to talk through any questions you may have.